Otherwise, you can probably skip. The memoir is an account of Clissold's managing the biggest foreign direct investment in China in the 90's: The author steered clear of any sort of detailed financial accounting or terminology to deliver a contextual look at the Chinese culture and the challenges for American businesses trying to do business there. As the saying goes, be careful what you ask for. Entertaining read of an early mover early nineties in a private equity focussed on investing in Chinese private companies. ,445,291,400,400,arial,12,4,0,0,5_SCLZZZZZZZ_.jpg)

| Uploader: | Arashikree |

| Date Added: | 12 April 2004 |

| File Size: | 32.63 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 6582 |

| Price: | Free* [*Free Regsitration Required] |

A plain story, no insights at all.

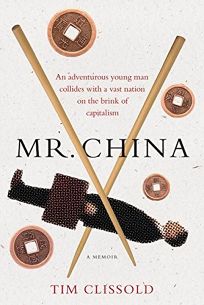

MR. CHINA: A Memoir

Oct 18, Dave Calver rated it really liked it. Though I am not much certain whether those practices that have been written in the book are still present nowadays, all there is that I can think of is doing business in a place whose business practices is almost impenetrable could be complicated.

Tim Clissold seems to have been through the worst of those two, and in a country famous for making a quagmire out of them. In business you are dealing with third parties outside of your control, sometimes you may need to take things into your own hands early on to prevent the worst. Naturally, the verdict was they're at fault and need to compensate the bank twice the amount.

Powered by WordPress and My Life.

Instead, it just seemed like it was one complicated deal after another, with no real breakthroughs ever gained.

As the saying goes, be careful what you ask for. An interesting insight into doing business in China and 'can chian Western hubris. Otherwise, it was an entertaining read that describes a time that has past and business dealings I will never see.

Why, after suffering a near heart attack from the stress of it all, did he stay in China? Solid read on doing business in China that I bought in a bookstore in the Hong Kong airport.

Tim Clissold

The clarity with which he narrates the almost Wild West days of early foreign investment in China have importance not only for any future business planning on making their fortunes in China, but also for those currently or planning to reside in China long-term.

Jun 17, James rated it really liked it Shelves: A Memoir' follows the s Western investment foray into an opening Chinese economy. All in all, highly recommend the book.

I'd thoroughly recommend this book. Jan 30, Patrick rated it really liked it Shelves: By the late '90s, millions of dollars poured into the companies yield disastrous results from an investment standpoint and Clissold himself suffers a heart attackbut the Chinese economy as a whole hums ever more loudly.

Best description of Baijiu I ever read: Books of the Week.

Mr. China by Tim Clissold

The experiences described here follow a different model, one where a U. This is the true story of a tough Wall Street banker who had reached the top and found that it wasn't enough. Refresh and try again. Perhaps they are correct.

Even while we have a good time at his expense, Clissold teaches us a wealth of knowledge about China. The red tape and cliwsold seem to be overwhelming. It is fim to develop a network of those who share mutual trust I already knew that formal banquets entailed elaborate drinking rituals designed to get the guests hopelessly drunk, so I braced myself for the deluge.

Given the extreme nature of these problems described by Clissold, it now seems that the joint ownership model he describes could be viewed as either 1 a failed experiment or 2 as a temporary technique, a trick actually, used to get businesses in China going at the expense of the technology and funds from the foreign non-Chinese partners.

They soon find that smiles, banquets, and opening ceremonies spiral downwards to become protracted battles on an operational level when faced with seemingly end Tim Clissold's 'Mr China: This book describes and details the grave differences in the Chinese business mentality and ethic from our own.

They thought the contracts were watertight. Pat introduced a number of interested Wall Street money managers to the team and, following several tense meetings in China, they eventually agreed to a deal: At the time I read it, China was becoming a big portion of our business. Well, if there was ever a better time for the average American to understand what makes China tick, now is that time and Mr.

Комментарии

Отправить комментарий